NBI SmartData Equity Funds

Turning big data into smart data

Sub-advised by Goldman Sachs Asset Management LP (GSAM)

Investment overview

The NBI SmartData U.S. Equity Fund and the NBI SmartData International Equity Fund, managed by Goldman Sachs Asset Management (GSAM), are generally made up of high quality large capitalization holdings that seek out potential excess returns. The Funds attempt to seize new investment opportunities by harnessing the power of big data to provide a competitive edge by sorting, analyzing and transforming complex datasets and ultimately gaining insight into the potential future profitability.

Why invest in these Funds?

The NBI SmartData Equity Funds are the results of putting the right data to work. A data-driven investment process built upon extensive and rigorous research, repeatable security selection and risk awareness. Big data is leveraged to search for new and unique insights that may be overlooked by conventional approaches.

Quantitative rules-based approach

A successful quantitative rules based approach that attempts in finding insights about a company and sector before the broad market prices it in.

Informational advantage

Use proprietary machine learning software to analyze big data themes.

Turning big data into smart data

Combining human judgment with processed unstructured data to transform big data into actionable ideas and results.

Why does big data matter?

- The value of information is essential in today’s world.

- Big data is all around us, transforming our lives. From smartphones to social media posts, data is constantly being generated and consumed.

- Benefits can be generated beyond technology by analyzing data sources for insights into future profitability and focusing on results.

- Data provides an informational edge for better informed final portfolio construction.

What is the approach behind this Fund?

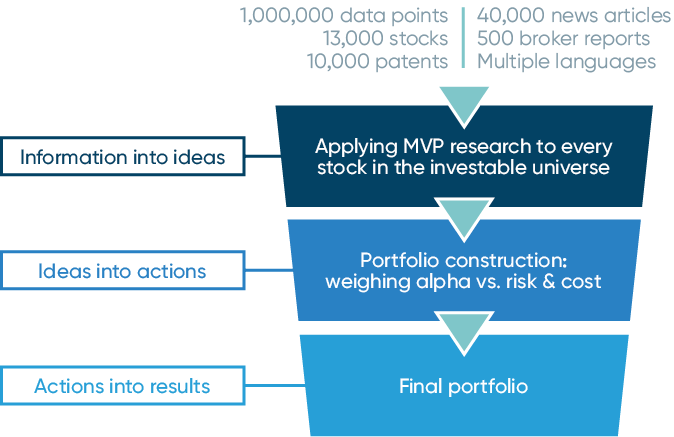

Data is at the core of the NBI SmartData Equity Funds’ investment model. Access to new types of data, along with the ability to capture and process data quickly, has given new ways to catch investment opportunities using three essential alpha (or return) drivers: momentum, value and profitability.

The approach is turning big data into actionable smart data. The strategy also relies on the pairing of human judgment and technology to produce best results.

Using big data to identify investment opportunities

Applying MVP research approach into every stock in the investable universe weighing return versus risk versus cost.

- Momentum: Use machine learning techniques to identify trending prices, themes, cumulative returns and analysts’ recommendations

- Valuations: A bottom-up approach to valuing companies based on underlying massive data

- Profitability: Analyzing unique data sources to provide potential insights into company growth based on multiple factors including but not limited to, online customer traffic and attention span

About the portfolio manager’s firm

GSAM’s Quantitative Investment Strategies team (QIS) is entirely dedicated to

- Established since 1989

- Managing over $88.8 billion in assets under supervision as of September 30, 2016

- Over 170 investment professionals with 15 years investment experience on average

- Globally integrated teams overseeing portfolio design and research, construction, ongoing management, risk analysis, quantitative solutions, execution strategies and system infrastructure

Advisor Series |

Series F |

T5 Series |

F5 Series |

H Series |

FH Series |

|

|---|---|---|---|---|---|---|

Initial sales charge |

Initial sales charge |

Initial sales charge |

||||

NBI SmartData U.S. Equity Fund |

||||||

NBI SmartData International Equity Fund |

Advisor Series |

||

|---|---|---|

Series F |

||

T5 Series |

||

F5 Series |

||

H Series |

||

FH Series |

||

Initial sales charge |

|---|

Initial sales charge |

Initial sales charge |

NBI SmartData U.S. Equity Fund |

||

|---|---|---|

NBI SmartData International Equity Fund |

||

|---|---|---|

Learn more about Series*

Learn about other investment solutions

NBI SmartBeta Equity Funds

These Funds use a rules-based investment approach centred on active returns that optimizes diversification and the risk/return ratio of a specific index.

Meritage Portfolios

An objectively managed solution featuring model portfolios of investment funds and exchange-traded funds from renowned firms.

Questions?

Contact your NBI Sales Representative

The information and the data supplied on the current page of this site, including those supplied by third parties, are considered accurate at the time of their publication and were obtained from sources which we considered reliable. We reserve the right to modify them without advance notice. This information and data are supplied as informative content only. No representation or guarantee, explicit or implicit, is made as for the exactness, the quality and the complete character of this information and these data. The opinions expressed are not to be construed as solicitation or offer to buy or sell shares mentioned herein and should not be considered as recommendations.

The NBI SmartData U.S. Equity Fund and the NBI SmartData International Equity Fund (the “Funds”) are offered by National Bank Investments Inc., an indirect and wholly owned subsidiary of National Bank of Canada, and sold by authorized dealers. Goldman Sachs Asset Management, L.P. acts as portfolio manager for the Funds. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the Funds before investing.

The Funds’ securities are not insured by the Canada Deposit Insurance Corporation or by any other government deposit insurer. The Funds are not guaranteed, their values change frequently and past performance may not be repeated.

® NATIONAL BANK INVESTMENTS is a registered trademark of National Bank of Canada, used under licence by National Bank Investments Inc.

National Bank Investments is a signatory of the United Nations-supported Principles for Responsible Investment, a member of Canada’s Responsible Investment Association, and a founding participant in the Climate Engagement Canada initiative.