The future is uncertain and that’s precisely why we should prepare for it

While investing is anything but an exact science, preparing for the future in a rational, systematic way has its benefits. And though 2020 has truly been a testament to unpredictability, our experts have carefully crafted their thoughts on what to expect in 2021.

What do our NBI experts think?

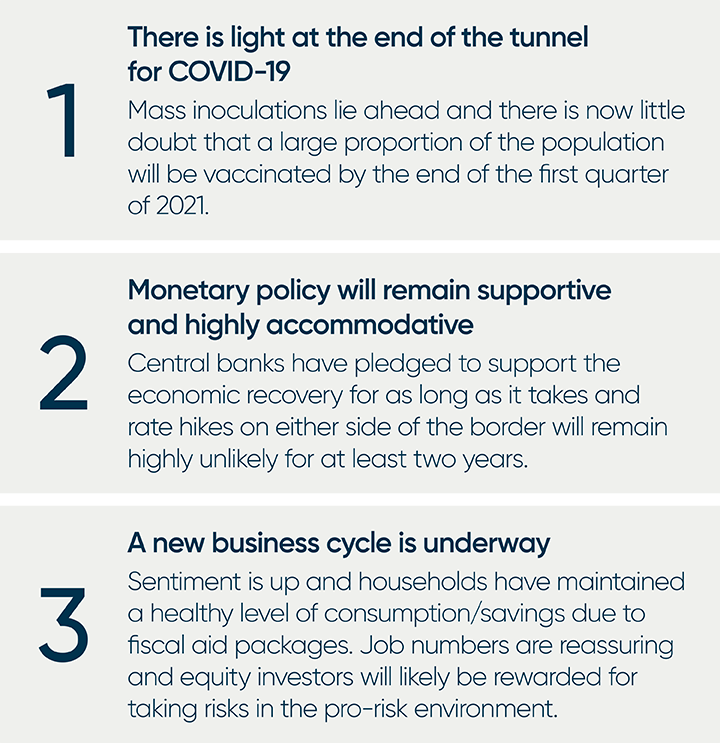

The inauguration of U.S. President-Elect Joe Biden means there will be much less drama on the political stage, but stints of volatility are still expected in 2021. Nonetheless, it will likely pan out to be a pro-risk year with plenty of reasons to be optimistic:

Equities and bonds

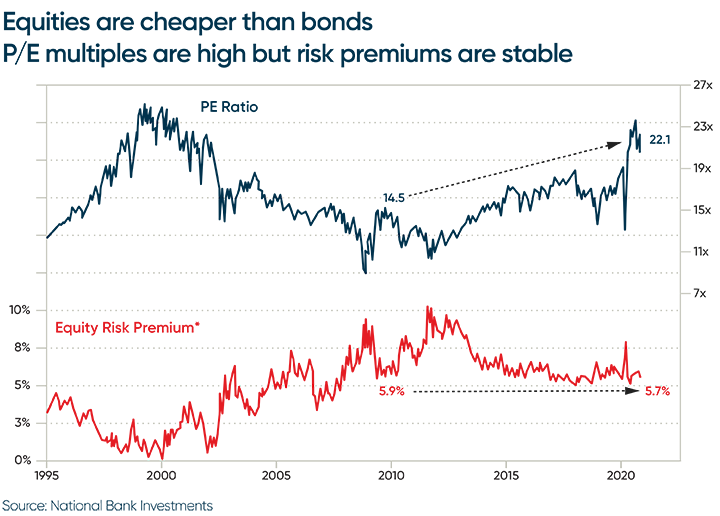

Risk/return for fixed income is looking be less attractive going into 2021 and for this reason, equities are favoured over bonds.

U.S. equity multiples are high but the risk premium over bonds is roughly where it was at the same point in the previous stock market cycle and far from the “irrational exuberance” of the early 2000s (see chart below).

The spread between dividend and government bond yields has not

been this much in favour of equities since the late 1950s.

The U.S. dollar should continue to depreciate in 2021. The logical result of the looming economic scenario is that the loonie, as well as emerging market currencies, should continue to appreciate over the next 12 months.

And the NBI awards for 2020 go to…

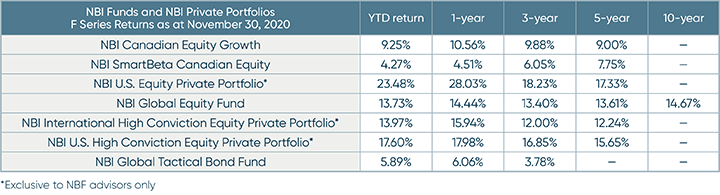

2020 was met with lots of challenges. As cases of the novel coronavirus began to surge worldwide, governments were forced to impose lockdowns and put forth aid packages to curtail one of the greatest economic contractions since the Great Depression. Yet, as central banks kickstarted the economy, households and firms largely stayed afloat and markets recouped most of their loses.

In this environment, the following NBI mandates have been singled out for displaying resiliency during the year:

For more information, NBI’s CIO Office regularly shares their

insights and perspective on markets, the economy and current trends in

the industry. For up to date publications, visit nbinvestments.ca.