NBI Global Tactical Bond Fund

Better navigate the fixed income world

Sub-advised by Insight North America LLC

Investment overview

Global bond funds provide more opportunities to generate added value than portfolios that invest in bonds from a single country. By diversifying investments across multiple geographic regions, investors will benefit from a combination of global bonds whose countries, maturities and credit ratings vary in order to optimize return potential.

Key differentiators

Generates value

A much broader securities universe, with more investment opportunities.

Mitigates risks

Greater diversification reduces risks associated with interest rates and credit spreads

Increases opportunities

Divergent yield curves can create attractive investment opportunities

Why invest in this Fund?

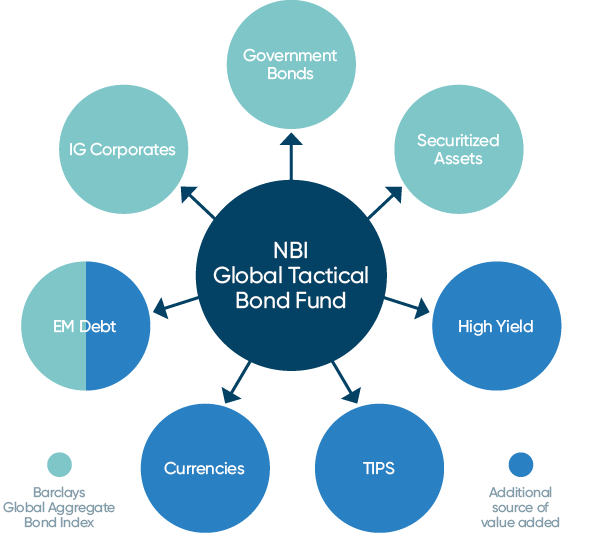

The NBI Global Tactical Bond Fund aims to generate income and capital growth while focusing on capital preservation. To do so, the portfolio sub-manager uses an active management strategy focused on security selection and an asset allocation based on countries, duration, the yield curve, currencies and sectors.

The Fund seeks to generate positive returns while staying diversified in the different constituents of its benchmark along with other assets classes.

- Mainly high quality investment grade portfolio

- Low correlation with other classes of fixed income assets

- Experienced investment team

- Fixed or variable distribution

Fixed distribution: fixed annual distribution of 4% paid monthly (see disclosure in prospectus). Fixed distributions are composed of net income and return of capital. The distribution amount per unit is said to be fixed as it does not vary from one distribution to another. Any capital gains are distributed each December.

Variable distribution: variable distribution are income made up of interest and capital gains, paid monthly. If the management expense ratio (MER) is higher than the income generated during this month, no distribution will be paid. Distributions may vary from month to month. Any capital gains are distributed each December. Distribution targets for the Funds are re-assessed annually in January.

About the portfolio manager’s firm

New York based Insight North America LLC is a wholly owned subsidiary of BNY Mellon Investment Management, one of the leading investment and wealth management organizations in the U.S. and the world.

|

Variable distribution |

Fixed distribution |

||

|---|---|---|---|---|

Advisor Series |

F Series |

T Series |

FT series |

|

Initial sales charge |

Initial sales charge |

|||

NBI Global Tactical Bond Fund (CAD) |

||||

NBI Global Tactical Bond Fund (USD) |

||||

NBI Global Tactical Bond Fund (CAD) |

|||

|---|---|---|---|

Variable distribution |

Advisor Series |

Initial sales charge |

|

F Series |

|||

Fixed distribution |

T Series |

Initial sales charge |

|

FT series |

|||

NBI Global Tactical Bond Fund (USD) |

|||

Variable distribution |

Advisor Series |

Initial sales charge |

|

|---|---|---|---|

F Series |

|||

Fixed distribution |

T Series |

Initial sales charge |

|

FT series |

|||

Learn more about series*

Questions?

Contact your NBI Sales Representative

1. The cash distribution amount per unit for the FT, R, T and O Series is said to be fixed as it does not vary from one distribution to another. However, it is not guaranteed and may vary according to market conditions. Distribution targets for the FT, R, T and O Series are re-assessed annually in January. FT, R, T and O Series distributions are made out of the portfolio's net income and may include a significant return of capital component.

The information and the data supplied on the current page of this site, including those supplied by third parties, are considered accurate at the time of their publication and were obtained from sources which we considered reliable. We reserve the right to modify them without advance notice. This information and data are supplied as informative content only. No representation or guarantee, explicit or implicit, is made as for the exactness, the quality and the complete character of this information and these data. The opinions expressed are not to be construed as solicitation or offer to buy or sell shares mentioned herein and should not be considered as recommendations.

The NBI Global Tactical Bond Fund (the “Fund”) is offered by National Bank Investments Inc., an indirect and wholly owned subsidiary of National Bank of Canada, and sold by authorized dealers. Gestion d’actifs BNY Mellon Canada acts as portfolio manager for the Fund and Insight North America LLC acts as portfolio sub-advisor for the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the Fund before investing.

The Fund’s securities are not insured by the Canada Deposit Insurance Corporation or by any other government deposit insurer. The Fund is not guaranteed, its value change frequently and past performance may not be repeated.

® NATIONAL BANK INVESTMENTS is a registered trademark of National Bank of Canada, used under licence by National Bank Investments Inc.

National Bank Investments is a signatory of the United Nations-supported Principles for Responsible Investment, a member of Canada’s Responsible Investment Association, and a founding participant in the Climate Engagement Canada initiative.