With these ambitious goals, member states hope to achieve tangible results by 2030. The UN estimates that the global investments needed to achieve them within the allotted timeframe could amount to some USD 7 trillion annually.1 The contribution of both the private and public sectors of all countries around the world is therefore not only to be hoped for, but indispensable.

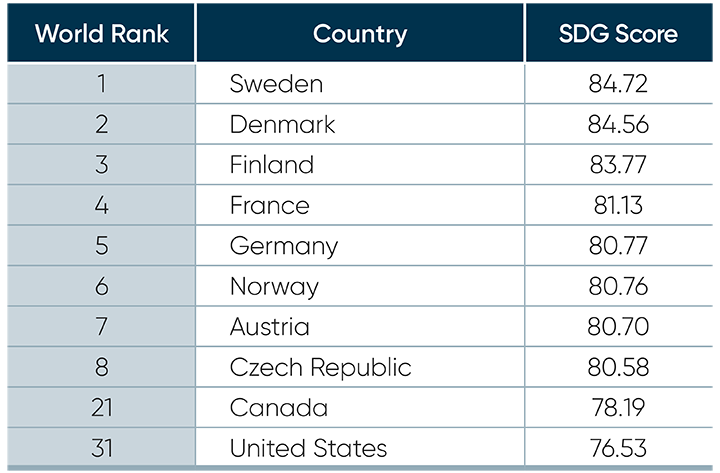

To this end, the UN annually ranks the progress each member state makes in achieving the SDGs by 2030 in its Report on the Sustainable Development Goals.2 Each of them is given a score between 0 and 100, with 100 being the highest score. Below are the countries leading the pack, compared to the scores obtained by Canada and the United States for the year 2020:

“The greatest commercial opportunity of our time"

Citizens and various civil society organizations are increasingly relied upon to put pressure on governments around the world to redouble their efforts to combat poverty or climate change, for example. However, there are still doubts of the private sector’s willingness to have a real impact towards a more sustainable economy.

The truth is that the private sector can and must consider environmental, social and governance (ESG) criteria in their business decisions. In fact, evidence shows that efforts to this effect tend to create long-term value. According to Mark Carney, former Governor of the Bank of Canada and the Bank of England, and now UN Special Envoy on Climate Action:

“The carbon neutrality goal is the greatest commercial opportunity of our time. Companies, and those who invest in them and lend to them, and who are part of the solution, will be rewarded. Those who are lagging behind and are still part of the problem will be punished.”3

Companies and governments that are slow to initiate the shift towards a more sustainable economy are exposing themselves to extra-financial risks in the medium and long term. This is why it is necessary to complement traditional financial analyzes with approaches related to responsible investing, such as the creation of a sustainable portfolio.

Innovation is central to our products

And that's where NBI comes in. Our ambition is to be an accelerator that promotes the growth and evolution of investment solutions, with the aim of making a positive impact in the lives of our clients, employees and partners. Our leadership in responsible investing is very much aligned with this orientation.

As part of our open-architecture structure, portfolio managers who are responsible for sub-managing our Sustainable Development ETFs must ensure that they invest in securities that contribute to achieving one or more of the SDGs. In that sense, we can demonstrate that our Sustainable Development ETFs contribute positively to the common good while creating value for investors.